怎么挑选债券基金收益

Title: Guide to Selecting Bond Funds

Investing in bond funds can be a strategic move for diversifying your investment portfolio and generating steady income. However, choosing the right bond fund requires careful consideration of several factors. Here’s a comprehensive guide to help you navigate the selection process effectively:

1. Understand Your Investment Goals:

Before diving into bond fund selection, clearly define your investment objectives. Are you seeking regular income, capital preservation, or capital appreciation? Your goals will determine the type of bond fund that best aligns with your needs.

2. Know the Types of Bond Funds:

There are various types of bond funds, each with its unique characteristics and risk profiles:

Government Bond Funds:

Invest in bonds issued by governments, typically considered lowrisk but offering lower returns.

Corporate Bond Funds:

Invest in bonds issued by corporations, offering higher yields but with increased credit risk.

Municipal Bond Funds:

Invest in bonds issued by state and local governments, providing taxexempt income for investors in certain jurisdictions.

HighYield Bond Funds:

Also known as junk bond funds, invest in lowerrated corporate bonds with higher yields but greater default risk.

Treasury InflationProtected Securities (TIPS) Funds:

Invest in bonds whose principal adjusts with inflation, offering protection against rising prices.

ShortTerm, IntermediateTerm, and LongTerm Bond Funds:

Differ in the duration of their bond holdings, affecting their sensitivity to interest rate changes.3. Assess Risk Tolerance:

Evaluate your risk tolerance and investment horizon. Bond funds vary in risk levels, with some being more volatile than others. Understand how fluctuations in interest rates, credit quality, and economic conditions can impact your investment.

4. Consider Fund Expenses:

Compare the expense ratios of different bond funds. Lower expenses can significantly impact your returns over time. Look for funds with competitive expense ratios relative to their peers.

5. Evaluate Historical Performance:

While past performance doesn’t guarantee future results, assessing a bond fund’s historical performance can provide insights into its consistency and riskadjusted returns. Look for funds that have demonstrated stability and outperformance relative to their benchmarks.

6. Review Credit Quality:

Examine the credit quality of the bonds held within the fund’s portfolio. Higher credit quality bonds (e.g., AAA or AA rated) tend to be less risky but offer lower yields, while lower credit quality bonds (e.g., BB or B rated) offer higher yields but come with increased default risk.

7. Check Yield and Duration:

Consider the yield and duration of the bond fund. Yield reflects the income generated by the fund’s holdings, while duration indicates its sensitivity to interest rate changes. Balance your need for income with the potential impact of interest rate fluctuations on the fund’s value.

8. Look for Diversification:

Ensure that the bond fund provides adequate diversification across issuers, sectors, and maturities. Diversification helps mitigate specific risks associated with individual bonds and enhances overall portfolio stability.

9. Pay Attention to Fund Manager Expertise:

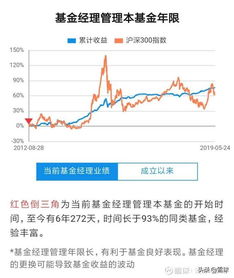

Assess the track record and expertise of the fund manager. A seasoned manager with a disciplined investment approach can add value and navigate challenging market environments effectively.

10. Consider Tax Implications:

For taxable accounts, consider the tax implications of investing in bond funds. Municipal bond funds may offer tax advantages for certain investors, while taxable bond funds may generate taxable income.

Conclusion:

Selecting the right bond fund requires thorough research and consideration of various factors, including investment goals, risk tolerance, expenses, performance, credit quality, yield, and diversification. By understanding these key elements and conducting due diligence, you can make informed decisions that align with your financial objectives and preferences. Consult with a financial advisor if needed to ensure that your bond fund selections complement your overall investment strategy and risk profile.

Invest wisely!

[End of Content]

This guide provides a comprehensive overview of how to select bond funds, covering key factors such as investment goals, risk tolerance, expenses, performance, credit quality, yield, and diversification. By considering these aspects carefully, investors can make informed decisions that align with their financial objectives and preferences. If you need further assistance or clarification on any aspect of bond fund selection, feel free to reach out to a financial advisor for personalized guidance. Happy investing!